By Prathmesh Limaye, Frost & Sullivan

The construction industry is grappling with issues pertaining to productivity and meeting project deadlines that have magnified since the 2008-2009 economic recession. Between 2007 and 2011, around two million construction workers were let go in the United States alone and the industry has not been able to fill this vacuum during the boom period that followed. This shortage is increasing labor costs and project timelines, which is pushing builders to look at options different than site built.

One such opportunity is building with modular/prefab, which is increasingly being used to build around the world. In the United States, the Modular Building Institute reports that the country’s modular construction business has doubled in size to $8 billion over the last five years.

We expect that number to grow – by a lot.

Adopting Modern Techniques

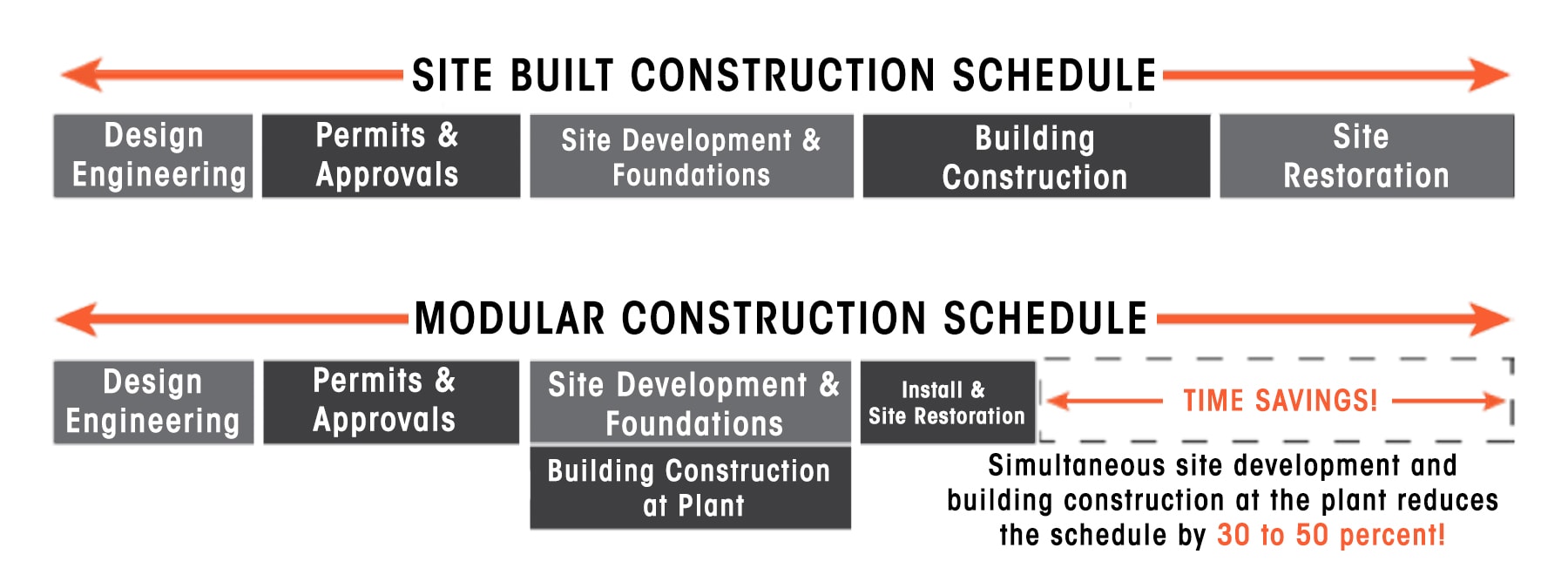

The industry is adopting innovative techniques to overcome productivity challenges and is borrowing heavily from the manufacturing sector. Off-site construction is an example of this. Industry stakeholders are looking to adopt modular and prefabricated techniques to help them complete projects in a shorter time frame.

Frost & Sullivan’s recent analysis, Global Modular and Prefabricated Buildings Market, Forecast to 2025, says that growth opportunities in the global modular and prefabricated buildings market look robust over the next six years. The analysis notes that a global uptick in construction activities and significant cost, labor and time savings in offsite construction are key factors driving market revenues toward $215 billion by 2025.

This growth in the adoption of modular and prefabricated building practices is paving the way for increased automation in the construction industry, which otherwise relies on manual processes, such as bricklaying, installation, and carpentry, all of which depend heavily on skilled labor.

What’s next?

With a constantly evolving regulatory landscape, adopting more environmentally sustainable and regulatory-compliant construction practices will boost prospects and revenues in the more mature markets of Western Europe and North America. Frost & Sullivan expects the market to expand at a sturdy compound annual growth rate of 6.3 percent from 2018 to 2025.

From a regional perspective, the recovering economies of Latin America, along with the high-growth markets of Eastern Europe, India, and Southeast Asia, are expected to provide lucrative market opportunities. Slower growth is anticipated in North America and Europe.

From a competitor position, the market is highly fragmented with several regional and smaller suppliers with wide market coverage. This is due to the relative ease of setting up a business in this space. I expect that the industry will experience consolidation in the coming years, with multiple merger and acquisition activities occurring in the foreseeable future.

Frost & Sullivan’s recent analysis explores the industrial, technological, regulatory and growth factors and trends that have shaped the global modular and prefabricated buildings market landscape, the challenges that lie ahead and the opportunities that can be tapped. The research provides a detailed analysis of the growth opportunities for key players in this space. End industries analyzed in this research include residential and non-residential construction, with contractors, developers and project owners classified as end-users.

The Global Modular and Prefabricated Buildings Market, Forecast to 2025 is part of Frost & Sullivan’s Chemicals & Materials in Infrastructure and Mobility research and analyses, which helps organizations identify a continuous flow of growth opportunities to succeed in an unpredictable future.

Modular and prefab are topics discussed by CURT’s Lean Project Delivery Committee, which focuses on improving productivity using various Lean principles. To learn more about this Committee’s focus, contact CURT by emailing construction-users@curt.org or by calling 513-563-4131.

Prathmesh Limaye is a building materials specialist consultant with Frost & Sullivan. He analyzes trends and technologies in the construction, building and CDIT retail sectors, and is an expert in assisting industry participants in identifying opportunities and evaluating market entry strategies.

CURT’S MISSION IS TO CREATE A COMPETITIVE ADVANTAGE FOR CONSTRUCTION USERS. CURT ACCOMPLISHES THIS MULTIFACETED OBJECTIVE BY PROVIDING AGGRESSIVE LEADERSHIP ON THOSE BUSINESS ISSUES THAT PROMOTE EXCELLENCE IN THE CREATION OF CAPITAL ASSETS.