By Anirban Basu, Chief Construction Economist, Marcum LLP

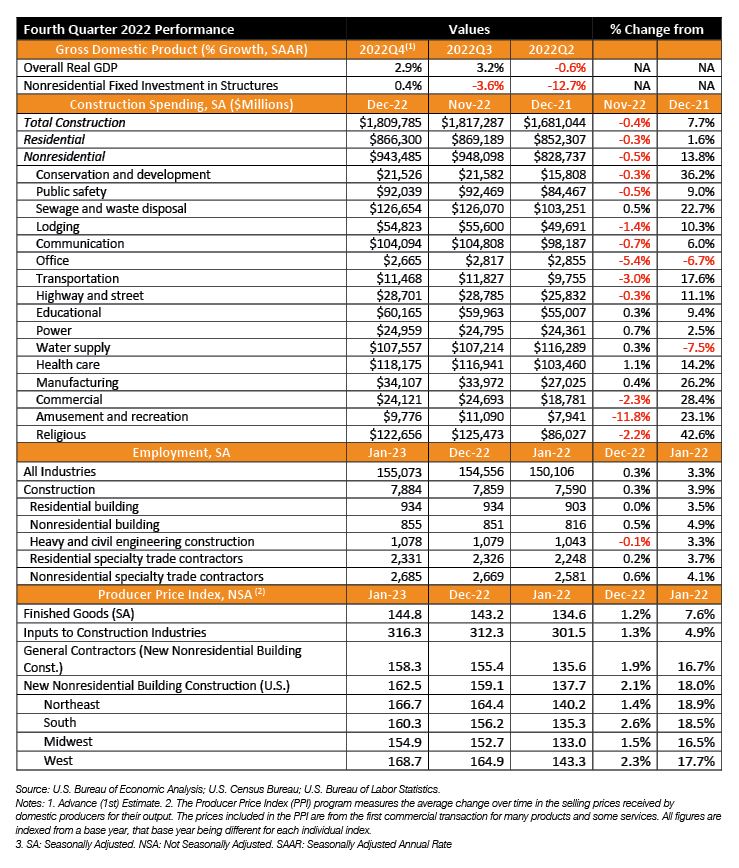

The construction industry faced many of the same headwinds that buffeted it throughout 2022 in the fourth quarter, including labor shortages, high interest rates, and elevated materials costs, but still exhibited a surprising amount of momentum.

Nonresidential construction spending outpaced inflation both quarterly and annually, and contractor confidence and backlog improved. Despite the solid performance of late, the economy remains overheated, which means the Federal Reserve will have to raise interest rates even higher than expected. The upshot is that economic momentum will fade as 2023 progresses.

THE GOOD

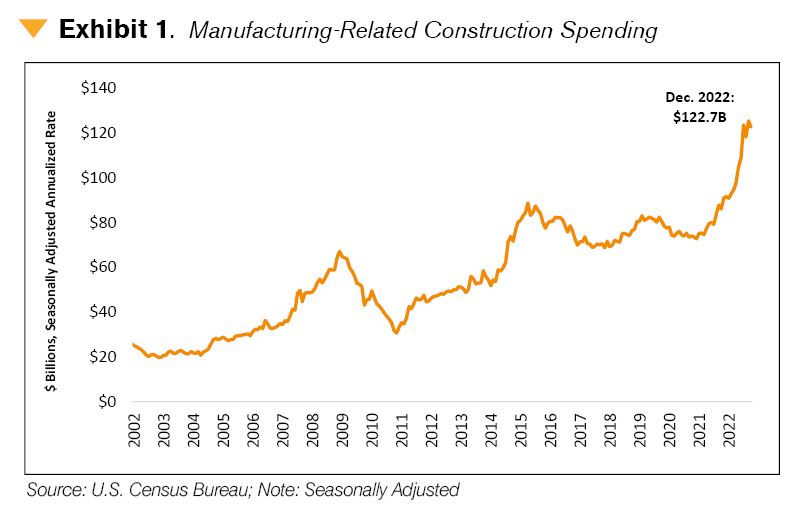

Manufacturing-Related Construction

Manufacturing-related construction remains the best performer among nonresidential construction segments. A combination of trade tensions, pandemic-induced supply chain anxiety, and a resulting effort to restore production has led to an array of massive domestic manufacturing projects. As a result, manufacturing-related construction spending is up 58.2% since the start of the pandemic, well above the 6.6% increase in overall nonresidential spending.

Given the scale and anticipated duration of many of these large-scale projects, the segment should retain momentum throughout 2023.

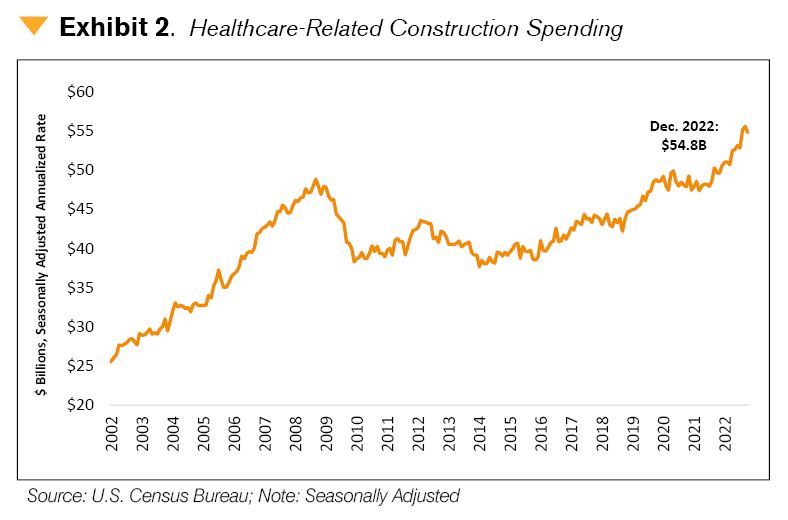

Healthcare-Related Construction

Construction spending in the healthcare segment increased rapidly in the year and a half leading up to the pandemic, but momentum stalled from February 2020 to September 2021 as care-related restrictions delayed many projects. Spending has surged since the fourth quarter of 2021; however, up 14.3% due to a combination of projects that were delayed during the early parts of the pandemic and demographic factors supportive of bolstered healthcare facilities.

Despite inching lower in December 2022, healthcare-related construction spending established a new monthly record in November 2022 and should retain momentum through at least the first half of 2023.

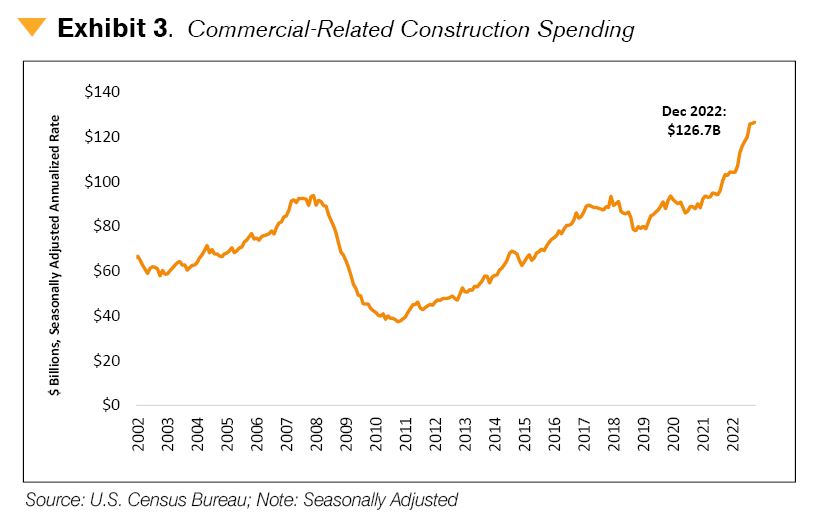

Commercial Construction

Commercial construction spending has surged 47.3% since the cyclical low point in August 2020 and currently sits at the highest level on record. Importantly, as defined by the Bureau of Economic Analysis, this segment encompasses several different types of construction, including retail, food/beverage outlets, car dealerships and service centers, warehouses and fulfillment centers, and farms.

The segment’s momentum over the past 2+ years is likely due to an increase in warehouse/fulfillment projects, while traditional brick-and-mortar retail construction has likely performed less well. While the boom in warehouse and distribution-related construction may be winding down, the commercial segment should retain momentum through early 2023.

THE BAD

Residential Construction

The Federal Reserve has been raising interest rates since March of 2022 in an effort to limit demand and reduce inflation. While much of the economy has proved surprisingly resilient in the face of higher borrowing costs, the housing market has been brought to a virtual standstill.

Permits for new residential construction were 27.3% lower in January 2022 than one year earlier. That’s largely due to falling demand for new single-family construction; permits for the construction of new one-unit housing structures have now fallen in ten consecutive months. Given that existing home sales fell 38.1% during 2022, that should come as no surprise.

Despite the decline in new construction authorizations, the number of single-family homes currently under construction is near the all-time high established in October 2022. While that’s partially due to the surge in new projects initiated during the housing boom of 2020 and 2021, it also has to do with how long it’s taking contractors to finish projects due to materials and labor shortages.

The multifamily market has fared much better as prohibitively high mortgage rates cause many would-be buyers to rent instead. Each of the previous three months has set a new all-time record for the most multi-family units under construction.

The upshot is that a large volume of residential construction is still happening, but activity in the sector is slowing down as high borrowing costs continue to take their toll.

Oil and Gas-Related Construction

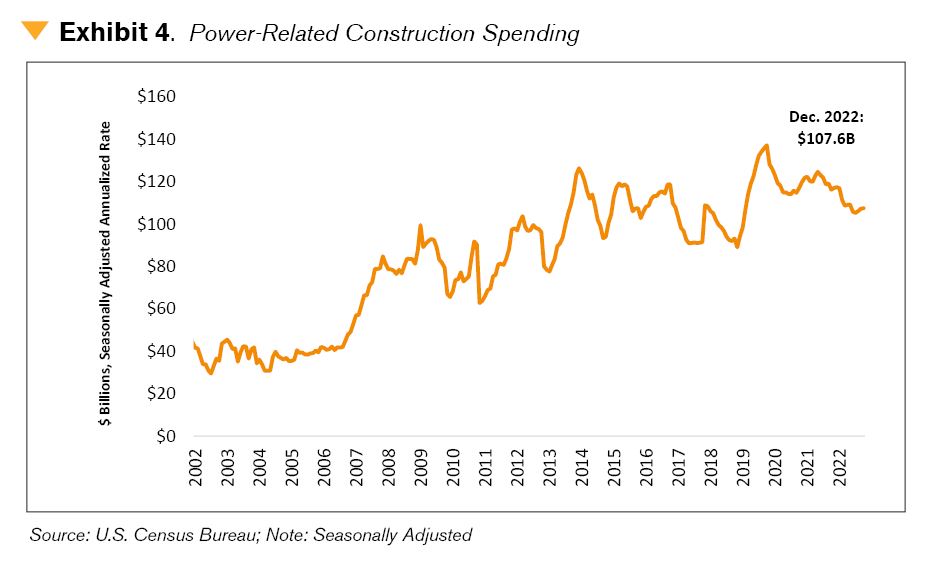

Construction spending in the power category, which encompasses oil, gas, and electric, is down 7.5% over the past year and more than 20% since the all-time high established in November 2019. At the start of the pandemic, power-related construction accounted for 14.2% of all nonresidential spending. As of December 2022, that share had fallen to 11.4%.

Given electrical grid problems in certain regions of the U.S., the broad push toward investment in renewables, and the elevated importance of energy independence in the face of Russia’s invasion of Ukraine, the lack of momentum in the power segment comes as a surprise. While the cause or causes of the decline remain unclear, materials and labor shortages and regulatory hurdles have likely played a large role in the segment’s recent weakness.

Recent funding for clean energy projects announced by the White House, including several billions of dollars allocated to electricity infrastructure and clean-energy projects through the Infrastructure Investment and Jobs Act, should help at some point, but energy-related projects often face significant hurdles due to environmental review and local stakeholder pushback.

Publicly financed construction accounts for less than 10% of all power-related construction spending, and there’s been a dearth of private-sector investment in power of late. As of December 2022, private-sector power construction was down 8.6% year over year, the largest decrease of any of the 16 segments tracked by the Census Bureau.

Materials Prices

Material price escalation moderated during the latter parts of 2022, but construction input prices are still 37.7% higher than they were at the start of the pandemic. For context, economywide prices – subject to the worst bout of inflation in over four decades – are up 15.9% since February 2020, less than half the increase observed for construction materials.

There’s been an improvement of late in this regard. Supply chains appear to have untangled, and international shipping rates have fallen dramatically. According to the Freightos Baltic Index, global freight rates have plummeted 82.1% since the peak in September 2021. Construction input prices declined steadily over the second half of 2022, falling in five of the year’s last six months.

Unfortunately, input prices rebounded in January, increasing 1.3%, the largest monthly rise since June 2022. Much of that increase is due to jumps in prices for concrete products (+1.1%), copper wire and cable (+2.6%), and iron and steel (+0.5%).

Still, the 4.9% year-over-year escalation in input prices is the lowest since the beginning of 2021, and the worst of materials price increases appears to be firmly in the rearview. Unfortunately, the industry still must grapple with input costs that have risen at more than twice the rate of inflation since the start of the pandemic.

Construction Employment & Labor Supply

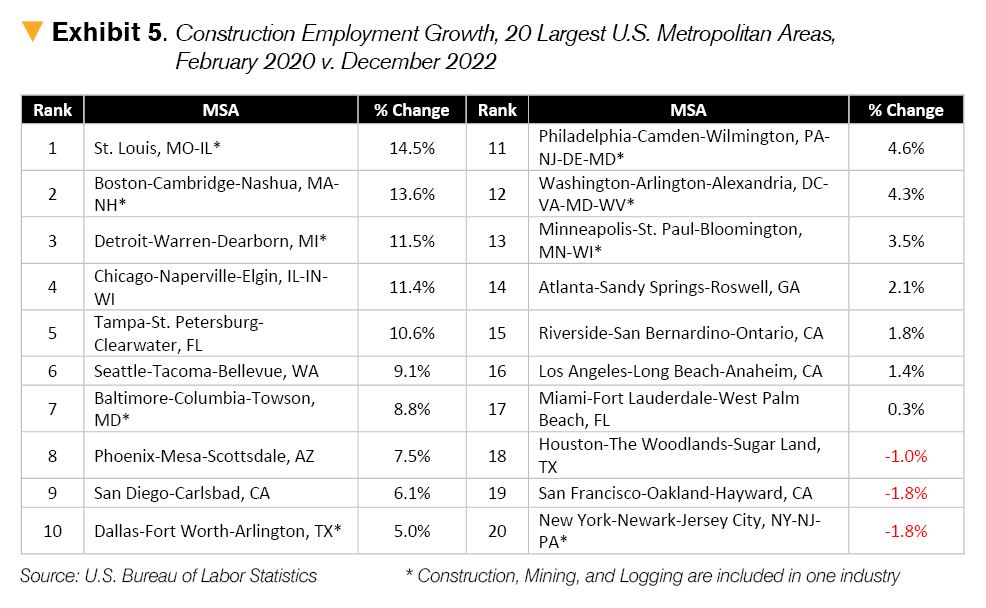

As was the case throughout all of 2022, the construction industry continued to be defined by high demand for labor but a pervasive shortage of workers. Construction employment increased by 25,000 in January 2023, a healthy hiring rate, and is 3.9% higher than in January 2021. Hiring was particularly brisk in the nonresidential sector, which has 4.9% more employees than it did one year ago.

Of course, hiring would be faster if not for ongoing worker scarcity. The industry averaged 390,500 open, unfilled jobs per month in 2022, by far the highest level on record, and as of December 2022, 5.0% of all construction jobs were unfilled. As a result, power dynamics have shifted significantly in the direction of workers.

On average, 2.4% of construction workers quit their job throughout 2022, well above the historical norm, while the rate at which contractors laid off workers remained historically low. As a result, construction wages are rising much faster than wages in all industries, further contributing to already elevated construction costs.

Regionally, large urban areas in the Midwest continue to outpace the remainder of the country in terms of construction hiring. This has a lot to do with the boom in manufacturing-related construction but also reflects regional labor markets that have slightly less constrained labor markets than the nation at large. The regions with contracting construction workforces, like New York City and San Francisco, continue to be associated with population decline and struggling office markets.

THE UGLY

An Overheated Economy

There was a moment in January when it looked like the Federal Reserve might pull off a soft landing, wrangling inflation down from its four-decade high while avoiding a recession. At that time, the rate of price increases had moderated, and job growth, while still rapid by historical standards, had slowed in each of 2022’s last five months. Retail sales had declined in each of the year’s final two months, dipping to the lowest level since March 2022. An array of indicators from the manufacturing sector indicated the kind of decline in demand necessary for inflation to fall back toward the target range of 2%.

Any celebrating that occurred was, to say the least, premature, and many of the conditions that led to the rapid price increases observed over the past two years have yet to abate. First, the labor shortages that have long plagued the construction industry are now affecting a majority of economic segments. As of December 2022, there were more than 11 million open, unfilled jobs –about 4 million more than in the months leading up to the pandemic – and 2 job openings per unemployed person. Put another way, if every American who wants a job got one, there would still be 5.5 million job openings.

As of this writing, there’s no sign of the demand for workers dwindling. Economywide, employers added 517,000 net new jobs in January, the most since July 2022 and roughly three times more than most economists expected. The unemployment rate sits at 3.4%, the lowest rate since the 1960s. Even with a barrage of layoffs from high-profile companies like Google, Microsoft, Twitter, SalesForce, and others, initial claims for unemployment insurance, the most real-time indicator of labor market performance, came in at 196,000 in the week ending February 4th. For context, initial claims for unemployment insurance averaged about 218,000 during the entirety of 2019.

Consumers, despite higher prices, continue to spend. After retail sales declined in November and December 2022, they rebounded 3.0 percent in January, an increase well above the consensus forecast of +1.6 percent. Even after accounting for inflation, retail sales are up an incredible 14.2 percent since the start of the pandemic.

Demand needs to fall back to a level roughly in line with supply in order for inflation to recede, and that hasn’t happened yet. As a result, inflation reaccelerated as 2023 began, and the 0.5% increase in the Consumer Price Index in January was the fastest since June 2022. While the year-over-year increase in prices registered in January was the lowest since the second quarter of 2021, the decrease from December (+6.445% y-o-y) to January (+6.347% y-o-y) was hardly encouraging.

All of this points toward more rate hikes, a slower path back to 2% annual inflation, and an elevated risk of a recession. The segments most exposed to rate hikes, like housing, have already felt the negative impacts, and higher borrowing costs will eventually catch up with the nonresidential sector.

Somewhat ironically, the economy’s current strength renders recession more likely over the next year or so, but that recession may arrive later – perhaps in the third or fourth quarter, or even 2024 – than some predicted. While the construction industry will likely maintain momentum throughout the current year, conditions in 2024 and 2025 may prove significantly more difficult.

JOE’S VIEW

(Joseph Natarelli, CPA, National Construction Industry Group Leader, Marcum LLP)

As we pour over the data from the last quarter of 2022, it’s easy to see the source of the financial concerns my clients are raising. But, ever the optimist, I want to remind you that there is always opportunity, no matter what the economic environment.

Between interest rate hikes and material cost escalations that continue in the construction industry, I have seen a lot of clients innovating to overcome price pressures – and those innovations can put money back into your business. R&D tax credits are among small business owners’ most overlooked incentives.

If your construction business has incurred research and development expenses related to developing or improving products, services, or processes – you may be eligible for an R&D tax credit that can apply to expenses including salaries, materials, supplies, and even consulting fees. Free money for innovating and pushing the industry forward?

If you ask me, that’s not too bad as far as silver linings go. Check with your Marcum advisor.

Marcum LLP is a national accounting and advisory services firm dedicated to helping entrepreneurial, middle-market companies and high-net-worth individuals achieve their goals. Since 1951, clients have chosen Marcum for our insightful guidance in helping them forge pathways to success, whatever challenges they’re facing.