Marcum Releases the 2023 National Construction Survey.

By Joseph Natarelli, CPA, Construction Services Leader, and Roger Gingerich, CPA, Midwest Construction Leader, Marcum LLP

The construction industry is grappling with the implications of rising interest rates, inflation, and changing economic dynamics, according to Marcum’s 2023 National Construction Survey.

The annual survey is conducted by Marcum, one of the leading construction accounting firms in the country. The survey covers a range of topics, from top priorities to problems, strategies, possible solutions, and the influence of a potential recession on the industry. The 2023 edition is the fourth iteration of Marcum’s national industry study.

Among this year’s key findings, companies are struggling with rising inflation and interest rates, with 50% expecting project delays or cancellations. Over half anticipate difficulty in passing expenses onto customers.

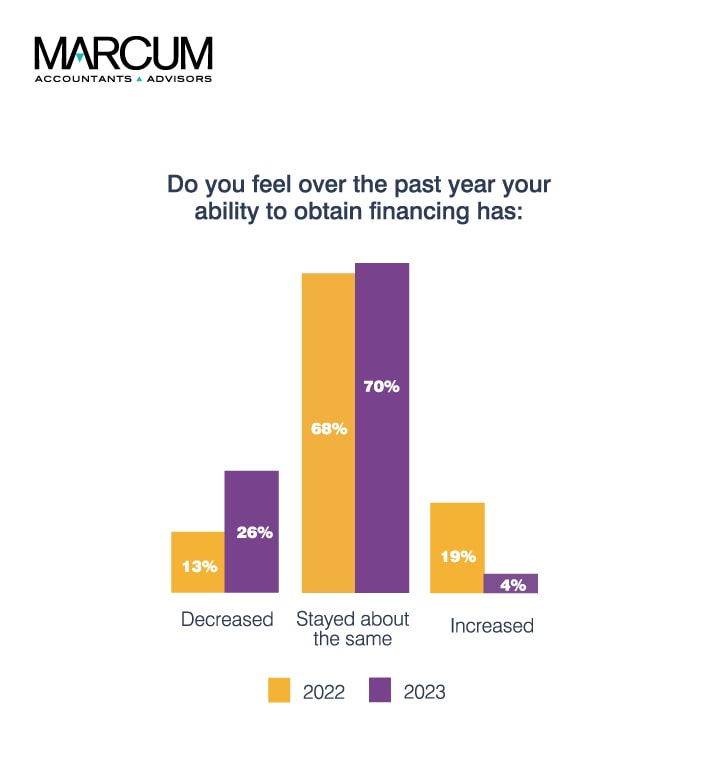

More than most, construction firms feel the sting of higher lending rates. Respondents in the survey pointed to a significant decline in the ease of obtaining financing, down to 4% from 19% last year. The survey also indicates increased difficulty in obtaining bonding. This issue is especially acute for firms with leveraged balance sheets and thin capital.

The report notes, “The percentage of those surveyed who saw a decrease in their ability to obtain financing doubled to 26% from last year, and those who found financing easier than in the prior year plummeted to 4% after hitting an all-time high of 19% in 2022.

Despite the challenges, the industry outlook is far from bleak. The survey reveals that the construction industry is showing impressive resilience. Just 32% of respondents are expecting a lower backlog this year, and those expecting a higher backlog are at 41% this year, just a 7% drop from the previous year.

“Despite the very real challenges presented by inflation and higher rates, no survey respondents think the sky is falling,” the report notes, adding, “In fact, some key indicators still show resilience in construction. Backlogs are only slightly behind their incredibly strong figures of the past couple of years, perhaps buoyed by a still-robust market in the public construction sector.”

Additionally, supply chains have improved, and material costs are stabilizing, with some sectors reporting declines. A sustained demand for skilled labor indicates underlying economic robustness.

“The survey’s results confirm what we have long known – the construction industry is not just about bricks and mortar but innovation, resilience, and adaptability,” said Joseph Natarelli, national leader of Marcum’s Construction Services practice. “Despite the current economic challenges, many firms view this as an opportunity to redefine their operations and strategic planning. We are confident that this sector’s dynamism and tenacity will enable it to emerge stronger.”

Other key findings of the 2023 report include the following:

- Increasing Costs: 60% of respondents report higher general and administrative (G&A) overhead expenses than in the past year.

- Taxes: Despite being the third-most important political issue, only 26% of companies are leveraging the Research and Development tax credit, suggesting potential lost opportunities.

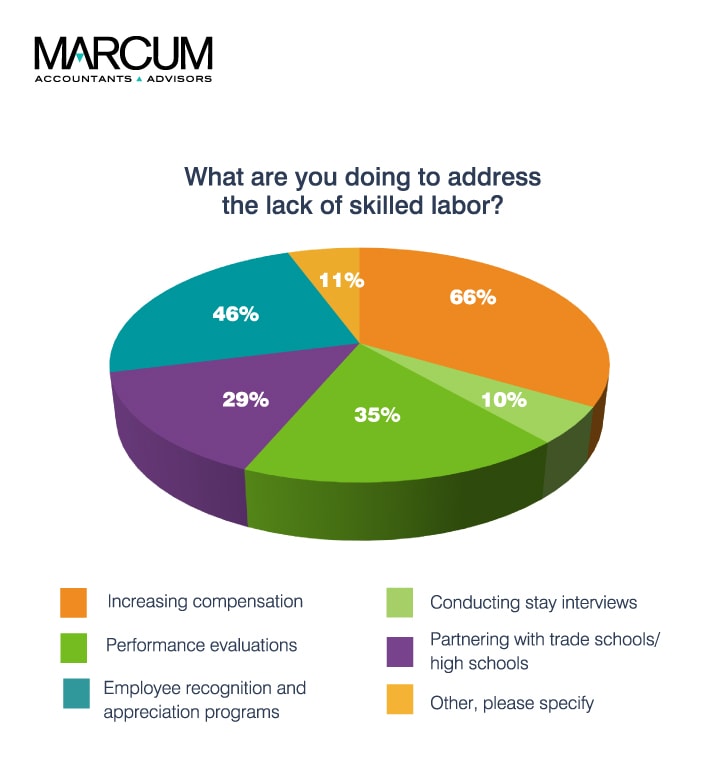

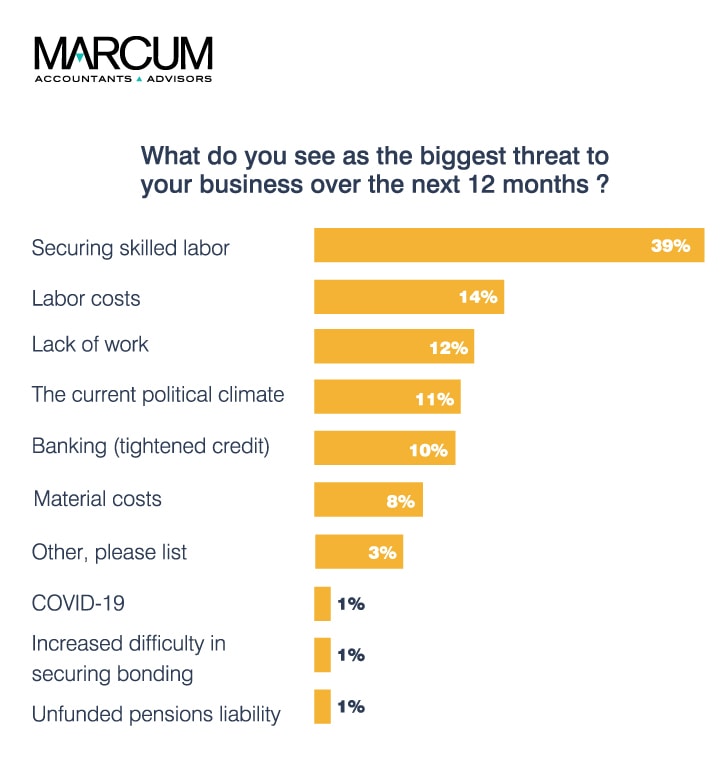

- Skilled Labor Shortage: 39% cite securing skilled labor as their biggest threat in the coming year, up from 27% in 2022. Labor costs are also viewed as a significant threat, doubling to 14% from the previous year.

- Pessimistic Outlook: Just 37% of respondents expect more project opportunities in their regions in the coming year, down from 59% last year. Those expecting fewer opportunities doubled to 26% this year.

- Recession Preparedness: 80% are focused on managing cash flow, and 59% are planning around a potential recession, up from 49% last year.

- Priorities Shift: There’s a marked increase in companies focusing on cost-cutting and sourcing skilled labor, with both seeing all-time highs of 47% and 50%, respectively.

- Healthy Backlogs Despite Challenges: Despite challenges, backlogs remain healthy. Companies are being more selective when bidding on projects due to a reduction in the number of competing bidders.

- Being nimble for tomorrow: The need to be nimble and ready for whatever is next was clear in how leaders of companies are prioritizing needs and anticipating a recession. The highest total ever – 80% – are focused on managing cash flow, while 59% are planning around a recession, up from 49% last year.

- What’s your exit strategy: The report notes that roughly 70% of business owners don’t have a plan for moving on from their business. Whether you’re young or old, interested in selling, or never planning to retire, a good succession plan is imperative. That number often surprises business owners, but the key part of building any succession or exit strategy is determining the full and fair value of the company.

“Despite the economic uncertainties brought about by the interest rate environment, our survey indicates a clear trend of resilience in the construction industry,” said Marcum Partner Roger Gingerich, who leads the firm’s Midwest construction practice. “The progress we’ve seen in areas like supply chain optimization and strategic planning is particularly impressive. While it’s a challenging landscape, our survey demonstrates the construction industry’s ability to navigate and adapt to these complex circumstances.”

Marcum’s 2023 National Construction Survey offers detailed insight into the industry’s strategic planning and cost-cutting measures and the significant impact of fluctuating interest rates and other economic trends. The Firm hopes this report will provide valuable perspectives for those facing similar challenges.

Please use this link to download a copy of the 2023 National Construction Survey.

About Marcum Construction Services

Marcum LLP is one of the leading construction accounting firms in the U.S., providing audit, consulting, and taxation services to clients ranging from start-ups to multi-billion-dollar enterprises. Among the country’s foremost experts in construction accounting, Marcum’s construction professionals are frequent industry authors and speakers and serve as technical reviewers for the AICPA’s construction audit and taxation guides. Marcum’s construction group also publishes several definitive industry reports and presents an ongoing series of industry summits and technical webinars focused on the unique needs of construction contractors.

About Marcum

Marcum is a top-ranked national accounting and advisory firm dedicated to helping entrepreneurial, middle-market companies and high-net-worth individuals achieve their goals. Marcum’s industry-focused practices offer deep insight and specialized services to privately held and publicly registered companies and nonprofit and social sector organizations. The Firm also provides a full complement of technology, wealth management, and executive search and staffing services. Headquartered in New York City, Marcum has offices in major business markets across the U.S. and select international locations. #AskMarcum.