By Trey Dodd, Senior Analyst, ButcherJoseph & Co.

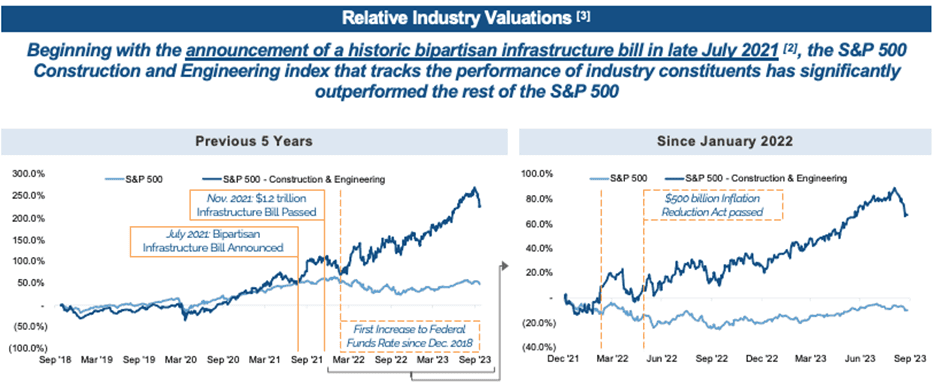

Despite interest rate, inflation, supply-chain, and labor-related headwinds, construction operators across the industry have recently benefitted from declining costs (including fuel and energy) combined with still-effective price increases implemented over the past several months. The increased profitability is supported by record public-sector spending on new construction projects over the next five-plus years, resulting in strong backlogs, increased project certainty, and improved overall health of the construction industry.1

KEY IMPACTORS

Demand

While elevated interest rates have tapered new housing starts, the U.S. housing shortage is estimated to exceed 3.5 million units.4 With many homeowners locking in reduced interest rates in 2020 and 2021, constructing new homes is required to offset the absence of selling homeowners. Further, commercial contractors continue to experience substantial demand for projects associated with chip manufacturing, clean energy facilities, and national infrastructure.

Labor

The construction industry has faced a challenging labor environment recently with a lack of skilled workers to fill open construction jobs. In response to heightened demand, the industry averaged more than 390,000 job openings per month in 2022, the highest level on record, and exhibited an unemployment rate of 4.6% in 2022, the second lowest on record, behind 4.5% in 2019.5 In 2023, demand remains elevated with limited labor availability, leaving employers in search of labor to remain competitive and complete mandates on time and on budget.

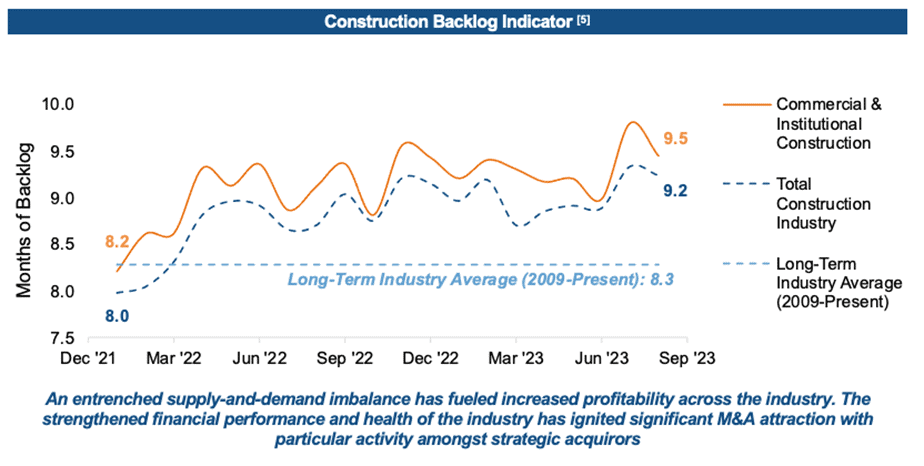

Backlogs

With record demand backed by federal funding, combined with a shortage of skilled workers, operators have developed multi-month project backlogs. As of August 2023, the average construction operator backlog is 9.2 months, a 15%+ increase from 8.0 months in January 2022 and more than 10% higher than the long-term industry average.

As federal and other legislative funding drive business performance for the foreseeable future, the supplemented product demand has led construction industry constituents to actively pursue mergers and acquisitions (M&A), both as buyers seeking to improve their market position and sellers seeking to capitalize on historic tailwinds.

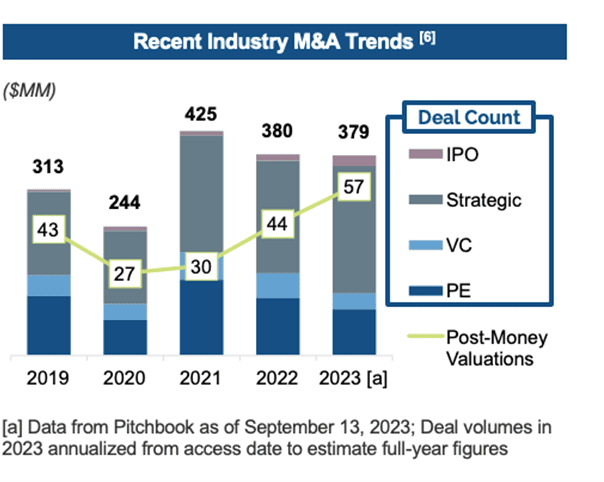

Following strong M&A activity in 2021 and 2022, deal volumes and valuations across the construction and industrial products industry have proven resilient.6 Underlying industry tailwinds have led executives to utilize M&A to capture market share, improve market positioning, and to establish redundancies throughout their supply chain by developing in-house manufacturing capabilities.

Strategic acquirers, which comprise +60% of year-to-date 2023 deal volumes, have relied on inorganic growth (i.e., M&A) over “greenfield investments,” which often take much longer to implement and are generally much riskier undertakings.

Construction operators seeking to sell their business have a variety of options, ranging from existing family members and executives to large industry conglomerates. Each buyer category has been impacted differently by the dynamic M&A and operating environments and thus maintains a differing level of appreciation for current tailwinds, backlogs, and industry outlooks – all of which impact a business’s valuation.

Strategic Buyers

Through “bolt-on” acquisitions, strategic buyers acquire capabilities, suppliers, customers, and/or employees and integrate them into their existing operations. As a driver of investment return, strategic buyers often seek cost synergies through 1) economies of scale that improve gross margin and 2) cost-cutting measures that reduce overhead expenses.

The current environment and increased profitability have elevated the purchasing power of strategic buyers, which are on track to increase deal volumes by 10%+ in 2023 as compared to 2022.6

Financial Buyers

In conjunction with the rise in interest rates, many financial buyers have sidelined origination efforts and have instead reserved deployable capital for existing portfolio companies. Asset managers have become increasingly focused on profitability in place of growth, and portfolio companies have largely followed suit.

Sponsor-backed portfolio companies have invested “organically” – increasing automation, hiring qualified employees, repaying comparatively expensive debt – and have attributed less time, energy, and capital to pursuing M&A opportunities. The result is that private equity and venture capital buyers are on track for a 20% and 30% decline in deal volumes, respectively.6

Employee Stock Ownership Plans (ESOP)

An ESOP is an employee benefit plan that offers workers a beneficial interest in a private company’s stock. For a selling shareholder considering an exit strategy, an ESOP sale allows sellers to realize the value of their company while retaining their legacy and rewarding their employees. An ESOP sale authentically aligns with the succession planning objectives of selling shareholders and maintains independence compared to selling to a strategic or financial buyer. Further, an ESOP’s tax-advantaged status provides additional cash flow to deleverage the business and invest in growth.

As rising rates create headwinds for market valuations, there has been increasing parity between third-party sales and sales to ESOPs. Plus, selling a business is more than just financial gain – your legacy in the community and the long-term well-being of the employees who have helped build the company also carry meaningful weight when deciding on when and how to sell a business. It is important that business owners weigh all the factors of a potential transaction – financial and non-financial – to determine what is best for their respective situations.

As a Senior Analyst, Trey Dodd supports a range of transactions, including mergers and acquisitions, capital raises, and valuation advisory. An experienced advisor can help business owners evaluate their options effectively. One of the services ButcherJoseph provides to business owners is a complimentary feasibility analysis study. This free service helps sellers learn more about the sale process, transaction structure, and the results for shareholders and the potential outcome for management and employees if an owner sells their business to private equity, a strategic buyer, or into an ESOP structure.

References:

- FMI Corp.

- .gov

- S&P Capital IQ.

- RSM International Ltd.

- Associated Builders and Contractors

- Pitchbook