JLL’s U.S. and Canada Construction Trends 2024 report details a positive outlook for the construction industry.

After a year of stabilization, the construction industry in the U.S. and Canada is positioned for success in 2024, thanks to strong demand and as the normalization of supply chains and material prices continues. JLL’s new U.S. and Canada Construction Trends 2024 report explores the opportunities and challenges facing the construction industry in the coming year.

“The industry is ready to successfully meet the challenges of 2024,” said Todd Burns, President, Project and Development Services, Americas, JLL. “With immense housing needs, return to office strengthening, and federally backed infrastructure and manufacturing accelerating, the industry is poised for growth despite challenges.”

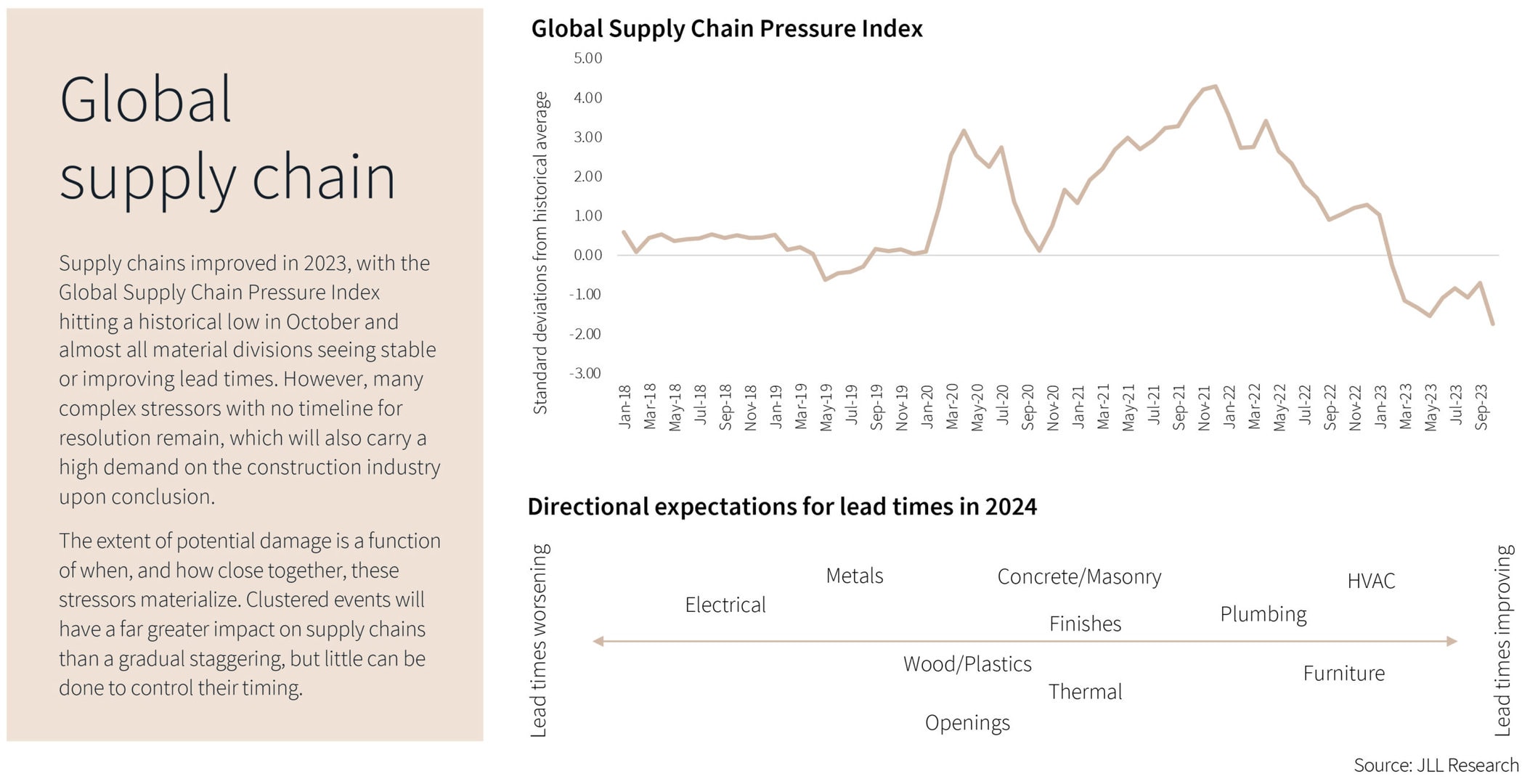

Supply Chains and Material Prices Will Normalize

Supply chains improved in 2023, with the Global Supply Chain Pressure Index hitting a historical low in October and almost all material divisions seeing stable or improving lead times. In 2024, slowing private-sector construction starts should keep supply chain pressure manageable, but the current pipeline and increase in publicly funded construction is anticipated to prevent price reductions.

“Electrical goods are the exception to widespread supply chain improvement and stability; data center demand, electrification, and more demanding tech-enabled spaces across sectors are keeping lead times long and prices rising,” added Andrew Volz, Research Lead, Project and Development Services, Americas, JLL.

Spending Will Vary

In the U.S., construction spending is expected to remain stable overall but will see variations from sector to sector. Looking at the numbers, material costs are expected to increase by 2% to 6%, employee wages are expected to increase by 3% to 5%, with total costs expected to rise by 2% to 4%.

In Canada, construction activity will likely continue to slow for the next few quarters; however, if inflation continues to slow and debt markets stabilize, this will give builders more confidence and could lead to a rebound in launches beginning in the spring of 2024. Material costs are expected to increase by 3% to 5%, employee wages are expected to increase by 4% to 6%, with total costs expected to rise by 3% to 6%.

“Construction investment in Canada reached record levels in 2022, due primarily to booming residential and industrial sectors,” said Rob Ramsay, Executive Vice President & National Lead, Project and Development Services, JLL Canada. “Rising interest rates have dampened activity by slowing the demand for real estate. A silver lining to a slowing economy is that softened demand normalizes inflation, helping to clear up supply chain bottlenecks.”

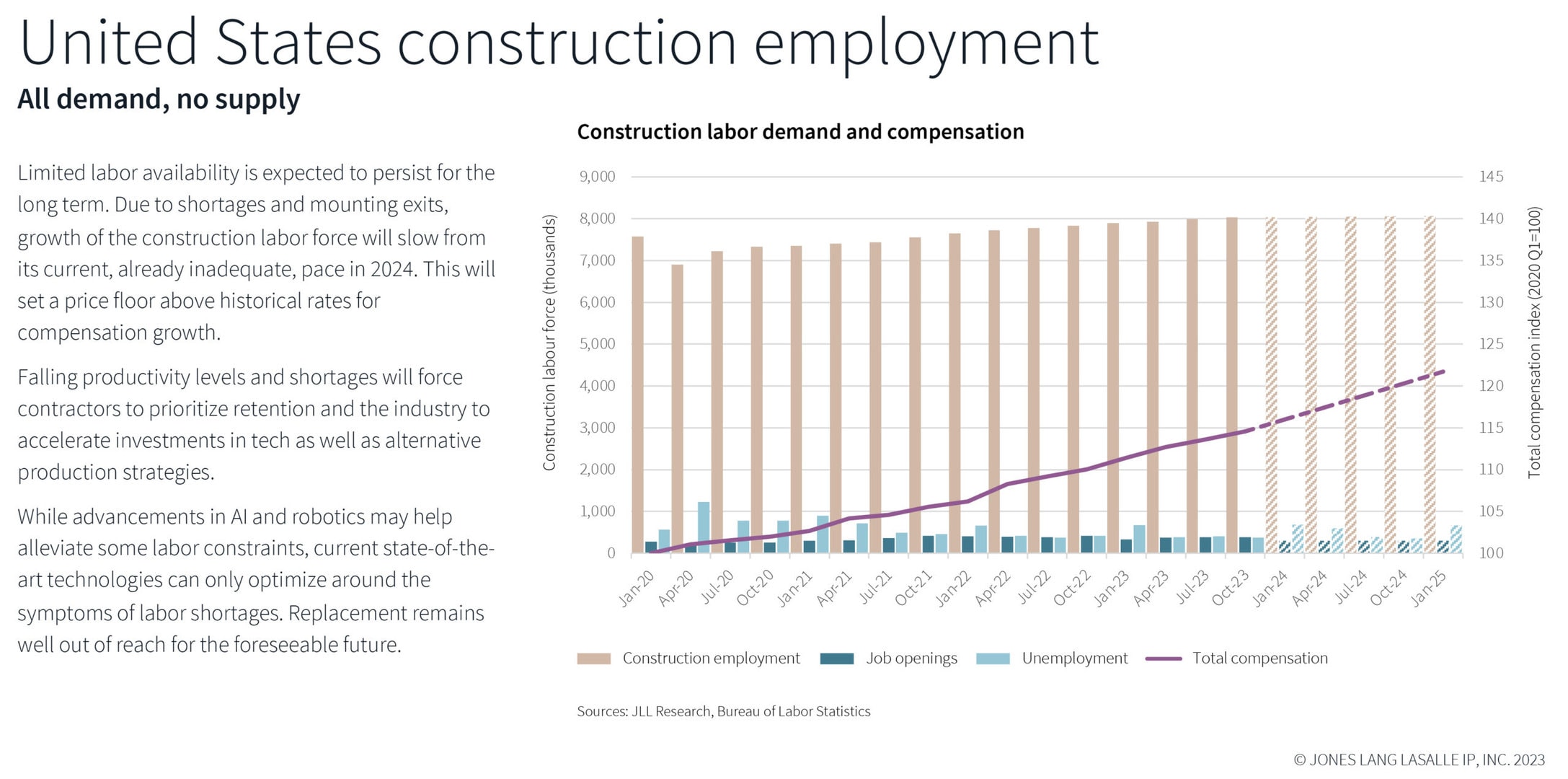

Labor Shortages Remain

In the U.S., limited labor availability is expected to persist for the long term. Due to ongoing labor shortages and an increase in people leaving the industry, overall growth of the construction labor force will slow from its current, already inadequate, pace in 2024. While advancements in technologies can ease some of these pressure points caused by the labor market, it cannot fully replace the need for labor.

In both the U.S. and Canada, as the industry faces skilled labor shortages and falling productivity – competency and efficiency will be increasingly valuable among the workforce. Retention, upskilling, and trust building are critical for the next year and beyond.

“Looking forward, success requires building durable partnerships with those who have not only the required technical ability, but also the soft skills necessary for problem-solving and innovation in the face of uncertainty,” added Ramsay.

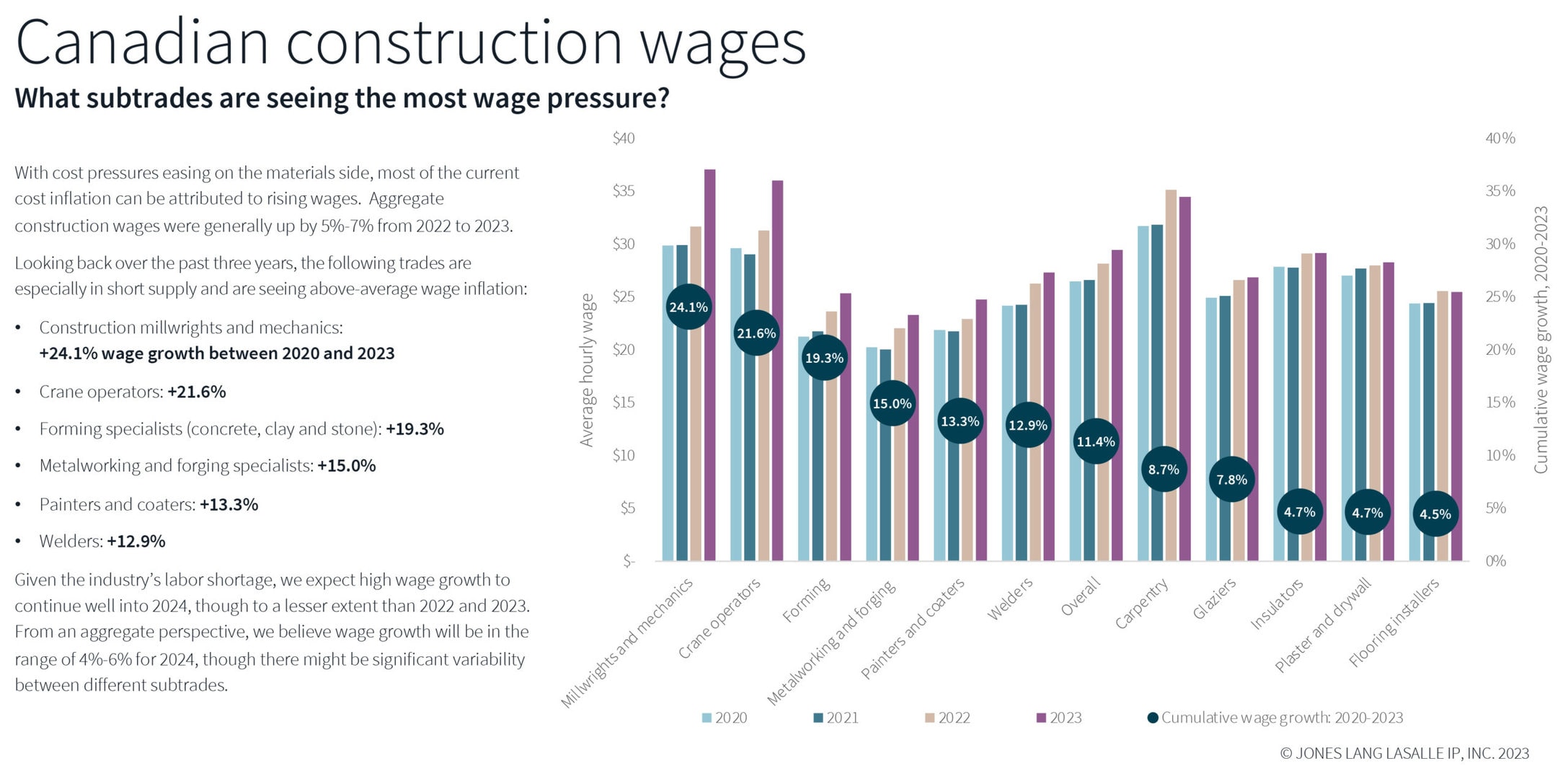

“With cost pressures easing on the materials side, most of the current cost inflation can be attributed to rising wages,” said Scott Figler, National Research Director, Canada, JLL. “Canada’s construction wages were generally up by 5% to 7% from 2022 to 2023 and we expect high wage growth to continue well into 2024 at around 4% to 6%.”

A Year of Growth

With all the factors impacting the construction industry in different ways, the outlook for the industry is positive. The global pandemic revealed inadequacies in our built environment, which the construction industry is the key factor in addressing – high-interest rates or not. Despite the overwhelming need to respond to these demands, there are many structural and complex issues to solve along the way.

“For a successful year ahead, it is imperative that industry leaders keep three strategies in mind,” Burns said. “They must know their people in order to retain talent, know their projects to understand what technologies can be used to assist, and know their markets in order to anticipate what is coming next and plan for success.”

For more news, videos, and research resources, please visit JLL’s newsroom.

JLL Project and Development Services is a leader in the development, design, construction, and branding of commercial real estate projects for the world’s most prominent corporations, educational institutions, public jurisdictions, healthcare organizations, industrial facilities, retailers, hotels, sports facilities, and real estate owners. Ranked No. 1 Top Development Company by Modern Healthcare, No. 3 in Building Design + Construction’s 2021 Construction Management Giants survey, No. 43 on Interior Design Top 100 Giants, No. 2 on Engineering News-Record’s 2021 list of Top 50 Program Management Firms and No. 4 on their 2022 list of Top 100 Construction Management-for-Fee Firms, JLL’s project management team comprises 8,500 project managers across 80 countries and is actively managing $99.4 billion under construction. Visit us.jll.com/deliver-projects to learn more.